Average Weekly Expenses for a 4 Person Family

Whether you're creating a new monthly budget or refreshing an erstwhile ane, y'all've probably noticed how important (and hard) information technology is to get your monthly expenses right. Underestimating or missing an expense can throw your whole spending strategy off balance, and so it's a skilful thought to explore some budgeting norms.

To help you become started, we've assembled a listing of twenty mutual things to include in a monthly budget, along with an average amount for each one that you can use every bit an initial benchmark.

20 Common Monthly Expenses to Include in Your Budget

1. Housing or Rent

Housing and rental costs volition vary significantly depending on where you lot alive. For example, the median home value in 2018 was $328,200 in New Bailiwick of jersey, but $140,100 in Ohio. Cost-of-living calculators tin aid yous adjust your budget estimates based on your location.

When it comes to a home loan, interest rates and the length of the mortgage also have a powerful effect on your monthly mortgage payments. Assuming a national average loan size of just over $245,000, a 30-year loan at 3.29% interest would cost $i,700 per month. A 15-year loan for the same amount at 2.79% interest would cost $ii,296 per month.

Rent varies in a similar way based on where you alive geographically. In 2021, the average monthly rent for a 1-bedroom apartment in Kansas was reported at $1,065. Movement to California, and that i-bedroom apartment will set up you back $2,670.

(The numbers that follow in this commodity are based on Department of Labor data unless another source is cited.)

2. Transportation and Car Insurance

Transportation is the second-largest budget item for virtually people, with boilerplate monthly expenses of near $819, including car payments, gasoline, and insurance. This should include all your regular expenses of commuting and but getting around town.

If y'all don't have a auto payment, y'all might include less for transportation in your monthly expense upkeep. On the other mitt, an older car might need a higher budget to cover the costs of maintenance.

Too, most car insurance plans let you save money if you pay for a total half dozen months in accelerate. If you build that pick into your monthly expense spreadsheet, saving enough each month to pay for your insurance up front, you'll come out ahead in the long run.

3. Travel Expenses

Travel expenses include things like weekend getaways, visiting family unit, traveling for piece of work, or anything that goes across your usual expenses with things like aeroplane tickets, hotel stays, and rental car costs.

If you're planning something big like a calendar week-long holiday, cross-country bulldoze, or overseas trip, consider creating a split upkeep for that expense and saving up for information technology in accelerate.

4. Nutrient and Groceries

Everyone has to eat—and most households spend an average of $610 on monthly groceries and eating out. Exist sure to calculate your household'due south weekly grocery trip costs and eating house expenses to create an achievable monthly food and grocery budget for you lot and your family unit.

v. Utility Bills

Idaho residents pay the to the lowest degree for their utility costs—heat, gas, h2o, electric, cable, and internet—at $344 per month, according to Move.org. Hawaiians pay the most for their utilities, at $731 per month.

You might exist able to lower the average monthly price of your utilities by foregoing cable and opting for streaming services with bones internet instead.

6. Cell Phone

The average cell phone bill runs from $35 to $140 for a family program, but you could spend every bit picayune as $9.99 a month if you only demand basic service with no data.

seven. Childcare and School Costs

Monthly childcare costs range from $401 per month in Mississippi to $1,886 in Washington, D.C. That'due south a huge range, and these are just averages. Check your local childcare options to decide how you might need to adapt your plan.

Once your children are of school age, you may demand to account for private-school tuition. But even if you send your children to public school, you'll demand money for various fees, school supplies, and occasional school trips. Adding room in your monthly expense tracker for school and childcare expenses is central to a successful and realistic budget.

8. Pet Nutrient and Intendance

It costs $twenty to $60 per calendar month to feed a dog, but y'all may need to spend more if your pet requires a special diet. You might also want to include something for pet preparation expenses and other care costs, similar treats.

9. Pet Insurance

The boilerplate monthly toll of pet insurance is $48.78 for dogs and $29.16 for cats. For $fourteen to $98 a month in premiums, you may be able to head off a big vet bill. If you opt for insurance, be sure to build your monthly pet insurance cost into your monthly expense list.

10. Clothing and Personal Upkeep

The average U.S. household spends $120 per month on vesture, co-ordinate to the U.S. Department of Labor, and you'll probably want to include personal grooming costs as well as any dry cleaning in this budget category.

The average monthly toll for personal care products and services ranges by individual, but haircuts, soap, toothpaste and other essential items all add up and should exist included in your monthly expense upkeep. The boilerplate person spends $lx per month on personal training expenditures.

If you lot purchase things like soap and shampoo at the grocery store, it might be easier to include those in your food and grocery budget category. If you lot purchase your shampoo, body wash, or other preparation items from a specialty store, be certain to include that corporeality in your monthly budget planner.

11. Health Insurance

If you don't have employer-based health insurance, you may want to buy a program. Monthly health insurance costs differ dramatically depending on your age, where y'all alive, and personal characteristics such as whether you smoke.

Depending on these factors, you could look to pay from $180 to $1,156 a month on health insurance plans. You may also demand to add more to that figure to account for deductibles, co-pays, over-the-counter medicines, and other healthcare expenditures.

12. Monthly Memberships and Subscriptions

The average gym membership costs about $58 per calendar month but can run significantly college. If a gym membership is an important part of maintaining your health, exist sure to include information technology in your monthly expense list.

While y'all're at it, now is a good time to have stock of all your monthly subscriptions. The average monthly cost of subscriptions is $237, and most people underestimate what they're spending.

Streaming services are amid the well-nigh obvious subscription expenses, but online publications, shaving clubs, monthly care boxes, vino clubs, and other recurring services are all included in your monthly memberships.

Since these services are usually paid for automatically every calendar month on a debit or credit bill of fare, information technology's easy to forget nearly them if yous aren't tracking them in a monthly expenses list or spreadsheet.

13. Life Insurance

Average monthly life insurance costs tin vary by state, but y'all can typically purchase term life insurance starting at about $thirteen per month.

When you're setting upwardly your monthly expenses budget, you might lump this corporeality in with the wellness insurance costs deducted from your paycheck if your life insurance is through your employer. If y'all accept a carve up, personal program, yous'll probably want to capture this expense in its ain budget category.

14. Homeowners Insurance

Renters or homeowners insurance can assist protect against theft, fire, and other kinds of threats or damage. The average renters' insurance cost is well-nigh $17 a month, while homeowners insurance costs roughly $35 a calendar month for every $100,000 in home value.

Renters insurance is bachelor to just nearly any renter, whether you're renting an apartment in a professional apartment complex or renting a private residence. Information technology covers you and your property from many kinds of damage and liability.

If you own your house, there's a good hazard yous're already paying for homeowners insurance through your mortgage. Yet, if your homeowners insurance isn't included in that payment, be sure to add information technology to your monthly expense upkeep.

15. Entertainment

A fundamental tip to a successful monthly expense budget is making room for fun. Figures on these items are hard to come past because they depend so much on what you like to practice. Still, y'all can put together a good estimate for your own monthly expense list with a little planning.

If you accept something specific in mind, such as going to the movies, dinner with a friend, or a weekly appointment dark, wait upward menus and pricing to effigy out how much money you lot'll need to allocate in your monthly upkeep planner for those activities.

16. Pupil Loans

Nearly 70 percent of 2018 graduates took out student loans, with an average of $29,800 in borrowing. Based on that amount, the boilerplate college graduate would owe $576 per month in student loan fees if they wanted to pay the loan off in five years at 6 percent interest.

17. Credit Bill of fare Debt

The average household credit menu debt is about $five,300. If yous bear the boilerplate balance and pay fifteen percent interest, yous could pay the card off in a yr with monthly payments of roughly $481.12.

If you endure from high credit card debt and interest rates, there are many ways to upkeep to pay down credit card debt, even if your monthly expenses are tight.

18. Retirement

The earlier you showtime saving for retirement, the longer your money can benefit from the power of compound interest. Some fiscal planners recommend setting aside 10 to 15 percentage of your income for retirement, but if you can salve even more, you'll reach your retirement goals more quickly and have more than protection confronting a market place downturn.

There are many ways to save for retirement and work on a long-term budget to retire on time.

19. Emergency Fund

Budgeting enough to save up 3 months' worth of expenses as an emergency fund tin can assistance see you through tough times. The boilerplate American household spent $61,334 in 2020, or $5,111 a month. Three months of expenses would suggest having a rainy-mean solar day fund of $15,333.

If you set bated $1,278 each month toward your emergency fund, you would accumulate $15,333 in a year. That amount might audio intimidating, so if you can't manage that in your monthly expense upkeep, start smaller, setting aside what you can.

twenty. Large Purchases

Will you need to buy a automobile in nearly v years? Put a new roof on the firm in two years? Make a list of these larger expenditures and create a set corporeality each month to add to your upkeep so yous can pay for them when the time arrives.

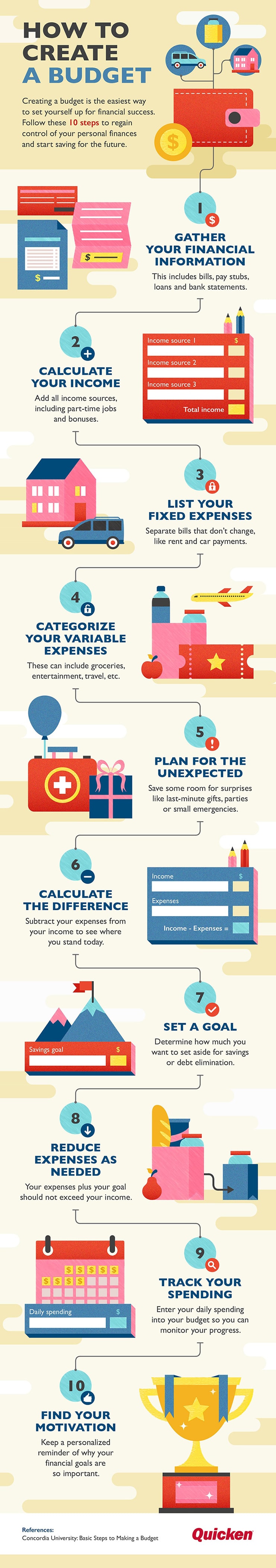

How to Create a Monthly Budget:

When you're set up to get started, creating a monthly upkeep requires 4 basic steps:

Stride 1. Calculate your income

Start with your net monthly income. In other words, figure out what you bring home every month afterwards taxes and other paycheck deductions. Once you know how much you take coming in every month, you'll know how much you tin can spend.

Stride 2. List all your expenses

Then, list all your monthly expenses. This includes needs, similar your electricity bill and groceries; wants, like streaming TV subscriptions and accept-out; and even planned savings, like monthly contributions to your 401(k) or emergency fund.

Exist sure to remember the bills yous pay quarterly, semi-annually, or annually too, such as certain insurance plans or property taxes.

Step 3. Subtract your expenses from your income

Add up the total of all your monthly expenses and subtract that full from your monthly income. That tells you how much you'll have left subsequently all your planned expenses to spend on other things. Consider using some of information technology to pay down debt faster or add together to your savings, and spend the rest on annihilation you lot like!

If your expenses are higher than your income, information technology's a good thing you decided to brand a upkeep! Take a look at each of your expenses to see where you might be able to cut dorsum, from pocket-size changes like eating in more often to bigger changes like moving or finding a roommate to share your living expenses.

Step 4. Create and track your budget on a monthly basis

At present that you have your monthly budgeting plan, the trick is to stick to it. Showtime past deciding how you want to keep upwards with your spending. If you desire to rail it by manus—whether on paper or in a spreadsheet—you'll need to write down all your transactions in each category every twenty-four hour period, from paying your bills to ownership that latte on the style to work.

Creating a monthly spreadsheet and keeping up with it is a lot of piece of work, but it'south an important step in taking control of your finances.

Monthly Budget Calculator:

Want some help figuring out how to make ends meet? Our free online budget calculator can walk y'all through the process of creating your monthly budget, including lots of helpful tips to aid y'all save money and make certain you're not leaving anything out.

Monthly Budget Spreadsheet:

Ready to create your monthly upkeep spreadsheet? If you want to create your own monthly budget spreadsheet, whether on newspaper or in a spreadsheet app, cheque out our five quick tips for creating a neat DIY monthly upkeep template.

If y'all'd rather rails your spending automatically, saving yous tons of fourth dimension every calendar month, consider an app that includes a monthly expense tracker to help you go started:

- Quicken Starter for Windows (includes companion apps)

- Quicken Starter for Mac (includes companion apps)

- Simplifi (mobile-showtime apps for iOS, Android, and the web)

Click image to see full infographic

massenburgarly1977.blogspot.com

Source: https://www.quicken.com/blog/monthly-expenses

0 Response to "Average Weekly Expenses for a 4 Person Family"

Post a Comment